How to Remain Compliant with International Regulation While Seeking Offshore Investment

How to Remain Compliant with International Regulation While Seeking Offshore Investment

Blog Article

All Regarding Offshore Investment: Insights Into Its Considerations and advantages

Offshore financial investment has actually ended up being an increasingly pertinent subject for individuals seeking to diversify their portfolios and improve financial protection. As we explore the subtleties of overseas investment, it comes to be apparent that notified decision-making is crucial for maximizing its potential advantages while mitigating fundamental dangers.

Understanding Offshore Investment

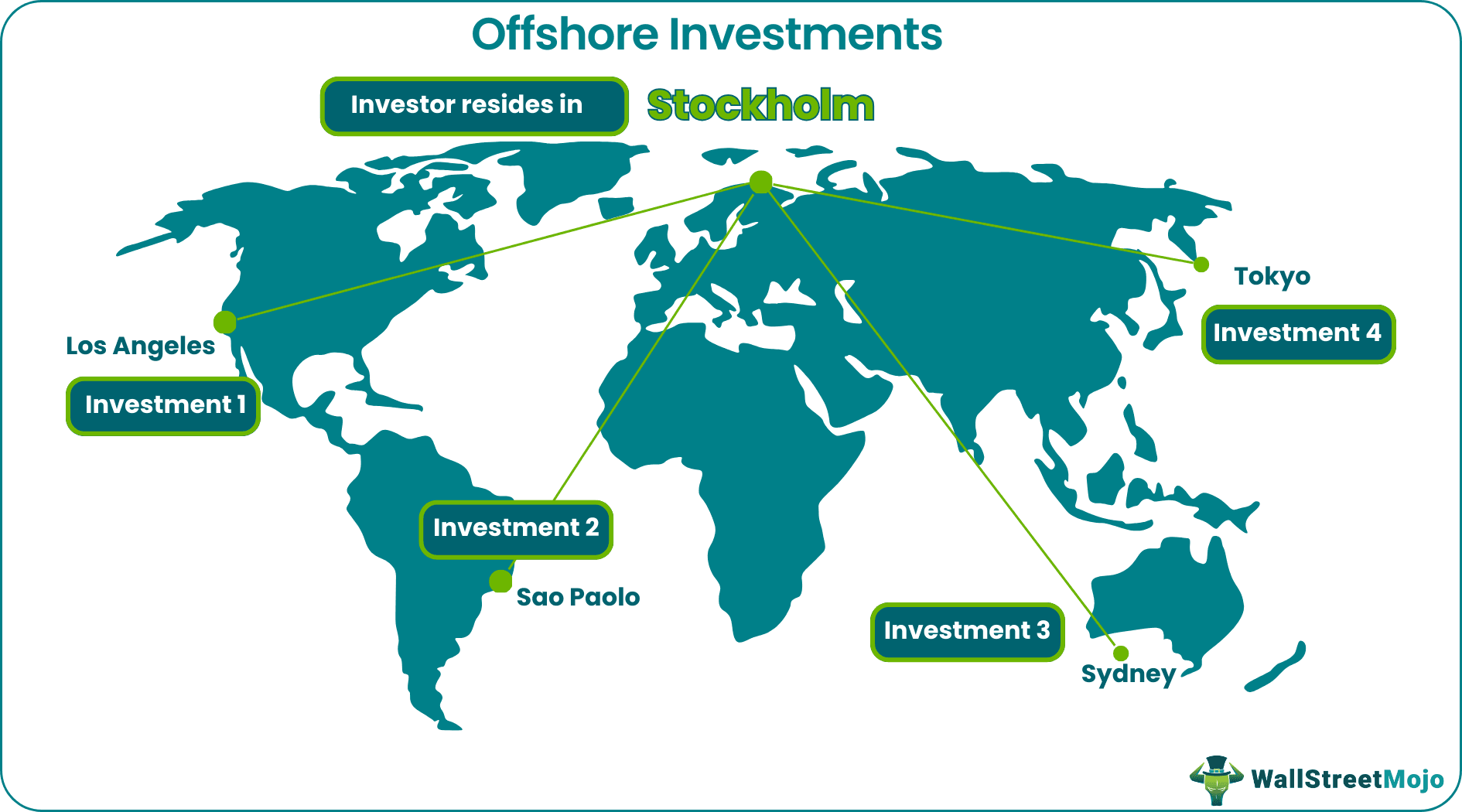

In the world of international finance, recognizing overseas investment is important for individuals and entities seeking to optimize their monetary portfolios. Offshore investment describes the placement of possessions in monetary organizations outside one's nation of residence. This practice is frequently used to attain various monetary objectives, consisting of diversity, property protection, and potential tax obligation benefits.

Offshore investments can incorporate a large range of economic tools, including supplies, bonds, mutual funds, and realty. Financiers might select to establish accounts in territories known for their desirable regulative settings, privacy regulations, and economic security.

It is vital to recognize that overseas financial investment is not inherently identified with tax evasion or immoral activities; instead, it serves legit objectives for numerous capitalists. The motivations for involving in offshore investment can differ extensively-- from seeking higher returns in developed markets to securing properties from political or economic instability in one's home nation.

Nevertheless, possible capitalists must additionally know the complexities involved, such as conformity with global laws, the necessity of due diligence, and comprehending the lawful effects of overseas accounts. On the whole, a comprehensive understanding of offshore investment is important for making educated monetary choices.

Secret Advantages of Offshore Financial Investment

Offshore financial investment supplies numerous key benefits that can boost a capitalist's financial strategy. One notable benefit is the potential for tax obligation optimization. Many offshore territories provide favorable tax regimes, permitting investors to minimize their tax obligation responsibilities legitimately. This can significantly raise total returns on financial investments.

Furthermore, offshore financial investments usually give accessibility to a more comprehensive variety of financial investment opportunities. Investors can expand their portfolios with assets that may not be conveniently offered in their home nations, consisting of worldwide stocks, realty, and specialized funds. This diversification can lower danger and boost returns.

In addition, offshore investments can promote estate planning. They allow financiers to structure their properties in a manner that lessens inheritance tax and ensures a smoother transfer of riches to successors.

Usual Risks and Difficulties

Purchasing overseas markets can offer various dangers and difficulties that call for mindful consideration. One significant danger is market volatility, as offshore financial investments might undergo variations that can influence returns drastically. Financiers need to additionally understand geopolitical instability, which can disrupt markets and impact investment performance.

Another challenge is currency risk. Offshore investments frequently involve transactions in foreign currencies, and unfavorable currency exchange rate movements can wear down revenues or boost losses. Offshore Investment. Furthermore, restricted access to trustworthy information concerning overseas markets can prevent enlightened decision-making, bring about possible mistakes

Absence of regulative oversight in some offshore jurisdictions can also pose hazards. Investors might locate themselves his explanation in settings where financier defense is very little, enhancing the risk of fraudulence or mismanagement. Varying financial techniques and social attitudes towards investment can complicate the financial investment process.

Regulatory and lawful Considerations

While browsing the complexities of offshore financial investments, understanding the regulatory and lawful landscape is important for ensuring and securing assets conformity. Offshore financial investments are commonly subject to a wide variety of laws and guidelines, both in the investor's home country and the territory where the investment is made. It is essential to carry out detailed due diligence to comprehend the tax obligation effects, reporting requirements, and any type of lawful commitments that may occur.

Governing structures can vary substantially in between territories, impacting whatever from tax to resources needs for international investors. Some countries may provide positive tax obligation regimens, while others enforce strict policies that might deter investment. Additionally, international contracts, such as FATCA (Foreign Account Tax Compliance Act), might obligate investors to report offshore holdings, enhancing the requirement for openness.

Financiers need to additionally know anti-money laundering (AML) and know-your-customer (KYC) laws, which call for economic establishments to validate the identification of their customers. Non-compliance can lead to serious charges, including fines and restrictions on investment tasks. Consequently, involving with lawful specialists focusing on worldwide investment law is necessary to browse this complex landscape efficiently.

Making Enlightened Decisions

A tactical strategy is necessary for making informed choices in the realm of overseas investments. Comprehending the complexities included requires detailed research and evaluation of various aspects, including market patterns, tax obligation ramifications, and lawful frameworks. Financiers must examine their threat tolerance and financial investment goals, guaranteeing placement with the distinct features of offshore chances.

Looking at the governing environment in the chosen jurisdiction is crucial, as it can considerably affect the security and earnings of financial investments. Furthermore, remaining abreast of geopolitical advancements and financial problems can provide important insights that inform financial investment approaches.

Involving with specialists that focus on offshore investments can additionally boost decision-making. Full Report Offshore Investment. Their experience can lead capitalists with the complexities of international markets, helping to recognize possible risks and profitable opportunities

Ultimately, educated decision-making in overseas investments rests on a versatile understanding of the landscape, a clear articulation of individual purposes, and a commitment to recurring education and learning and adaptation in a vibrant worldwide environment.

Verdict

To conclude, offshore financial investment provides substantial advantages such as tax optimization, property protection, and accessibility to worldwide markets. Nonetheless, it is critical to recognize the involved threats, including market volatility and governing difficulties. A complete understanding of the legal landscape and thorough research is important for effective navigation of this complicated sector. By dealing with these factors to consider, investors can successfully harness the my review here advantages of offshore investments while minimizing potential drawbacks, ultimately bring about informed and tactical economic choices.

Offshore investment provides several essential advantages that can improve a financier's monetary method.In addition, overseas financial investments usually give accessibility to a more comprehensive array of financial investment possibilities. Varying economic techniques and social mindsets toward investment can complicate the investment procedure.

Report this page